The Financial Crisis and “Fractal Explanations”

by Greg Fisher

The financial crisis is now over 3 years old and the explanations for the crisis have been well rehearsed. This blog takes issue with a number of the explanations for the crisis, and develops a new term, fractal explanations. Google indicates that I am not the first to use this term but I think it’s worth developing some more.

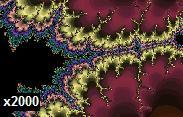

In a nutshell, fractal explanations of “whole system phenomena” are those based on micro explanations that can be scaled up and easily mapped on to the whole. Fractals are, according to Mandelbrot “a rough or fragmented geometric shape that can be split into parts, each of which is (at least approximately) a reduced-size copy of the whole”. The idea of a “reduced size copy of the whole” is key here.

For the financial crisis, such fractal explanations put the blame squarely with bankers and / or politicians: “it was bankers’ greed that caused the crisis”, “regulators are incompetent”, “politicians were complicit”, and so forth. In a way, such explanations are cosy for the majority not working in the financial system or politics, because we construct a victim narrative for ourselves. And, given the financial crisis appears to have cost the UK about 20% of GDP (about £300bn) in terms of bail-out costs, lost output, and unemployment, this is thought to scale bankers’ greed and political incompetence i.e. they’re THAT greedy, incompetent, and corrupt.

Put another way, if a person’s actions are represented by x and there are N people in a population, then fractal explanations mean that social phenomena can be thought of as Nx. And this is viewed as symmetric, so if we observe something at the macro level (like a financial crisis) we think of it as Nx, with N number of bankers, who are the x’s. So in this case, if the financial crisis was terrible, bankers must be too – in a mini-me kind of way.

I should state very clearly that these types of explanations are not necessarily wrong. For example, it is obvious that, on the whole, people with power typically try to retain that power. The financial system is no different, hence resistance from bankers to proposed reforms which might make the system safer. On the whole, individuals do act in their self-interest and these actions can contribute to systemic crises. So bankers are not entirely blameless.

However, fractal explanations of the financial crisis seem to imply that, given the scale of the recent crisis, all or most of the financial system was “in on it”. From a personal perspective, I cannot agree with this image. I worked in the financial system for about 13 years until early 2008, first at the Bank of England (a banker of bankers – OMG!) and then at a hedge fund, and I felt I did some good work and that those around me did too. I did not see a system-wide deliberate fleecing of the tax payer that fractal explanations seem to suggest.

But, by contrast, I can see that the financial system as a whole has fleeced the taxpayer to the tune of about 20% of GDP! So how do I synthesise these two personal perspectives? The answer is that the financial crisis should be viewed as a network effect or, to be more precise, and if we wanted to be more technical about it, it looks a lot like an emergent global cascade.

So in place of many (not all) fractal explanations of the financial crisis, I offer network explanations.

What do I mean? The new fields of network theory and the Complexity sciences help us to understand that system-wide events, like the financial crisis, also result from a system operating in an apparently robust and inoffensive way. But at times that same system proves fragile. The result is a financial system that I experienced – lots of good people doing good work – and which over the past decade (at least) has most certainly drained more value from the UK economy than it has contributed.

Another example of fractal explanations of system-wide effects is traditional Keynesian theory. This theory (the mathematical stuff, not my interpretation of Keynes, which I differentiated in this blog) aggregates micro variables like consumption and investment. It is not built on networked foundations that include interacting human beings in which system-wide “things” can happen. The idea of multiplier effects is useful but traditional Keynesian theory does not have an explanation for how recessions start and perpetuate (in part because, until Complexity and network theory came along, the theoretical technology did not exist). It just adds up the micro.

The other major explanation of system-wide effects like financial crises are conspiracy theories. In this approach, an elite group of bankers – with substantial power over the whole system – meet regularly to control it in ways that are favourable to them. They sit on top of major banks and can control the whole system. Again, I would not argue that vested interests don’t try to maintain their position in society – people often do. But these types of theories confer more controlling power on individuals than is practically possible in complex social systems.

Many of those pushing fractal and conspiracy theory explanations of the financial crisis will no doubt think me naïve: of course bankers are all greedy and of course there is a secret committee with enormous power, which maintains the status quo. Or perhaps I am on that committee and such network explanations are a part of an elaborate conspiracy theory. But I offer my own personal experiences of the financial system as evidence, in addition to the new conceptual tools we have from new fields of study. I remain open to other explanations based on empirical evidence and robust conceptual foundations.

But does it really matter if we get the explanations completely right? Actually, yes, a great deal. A number of policy makers are thinking along the lines of fractal explanations because network thinking has hardly penetrated the corridors of Westminster. Most voters have a similar view, and politicians have a survival-based habit of listening to their constituents. The risk is that in policy formation post-crisis we base our understanding of the financial crisis on fractal explanations, under-emphasising legitimate network explanations. It will result in bad policy, which will be no good for anyone.

Hi Greg

I like the idea of zooming in and out here – and how this can introduce proper real-world uncertainty into thinking about large-scale issues. For example, ‘it was bankers’ greed’… zoom in… yes, and some were more greedy than others… zoom in… yes, and within any given institution there was a range of views…zoom in… and within each particular team there were voices in different directions… and now we can see that it’s not as simple as all that.

What the zooming CAN make easier is getting away from the headline/soundbite and into a real world of many shades of grey. When the lighter (ie better) shades are acknowledged and noted, it becomes a lot more difficult for the darker shades to be hidden and overlooked. Each becomes clearer in contrast. So the less greedy banks/bankers/voices can be encouraged and built up.

This might also help to promote the idea of network thinking – as it becomes clearer how the actions of a few can influence the actions of many more. The idea that it’s not just the sum of the micro is hugely important.

Surely, it will result in bad policy not knowing the root cause of a crisis.

But, also “We can’t solve problems by using the same kind of thinking we used when we created them” (Albert Einstein).

So, in the first place, let’s use a different way of thinking, both a) away from finance / banking, and b) away from complexity, which is a too easy way of introducing allegedly inevitable catastrophes.

The best thing we can do to cope with finance / banking AND complexity is not to start making [evident] mistakes, in the first place.

The very first mistake is: if we know a) that finance likes to take gambling-like and bubble/bust-prone risks, and b) when those risks [truly] inevitably materialize, NOT ONLY finance will suffer, but also the real economy (which means people, and the poorest of them first), which did not want to take any of those risks, and did not profit of any of those risks, and therefore should NOT bear any cost whatsoever for those risks when they materialize, …well, letting things go that way was (and is) evidently stupid since the very beginning.

Well two decades ago I was repeatedly warning my colleagues in McKinsey about that issue, and invariably I got as answer the mantra: “finance optimally allocates risks”.

So, the very first mistake is stupidity.

Given that, add greediness, and the certainty from complexity (and from Murphy as well) that the worst will come, and the recipe for disaster is ready.

Discussing about it now is equally stupid, I’d say…